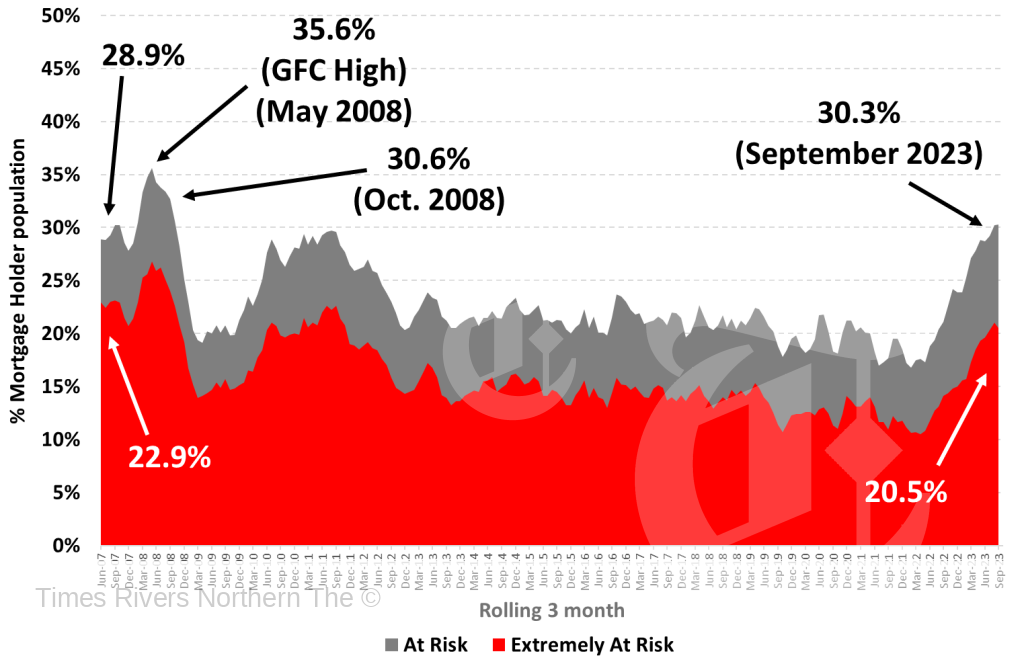

Over 1.57 million Australians are now ‘At Risk’ of ‘mortgage stress’ representing 30.3% of mortgage holders

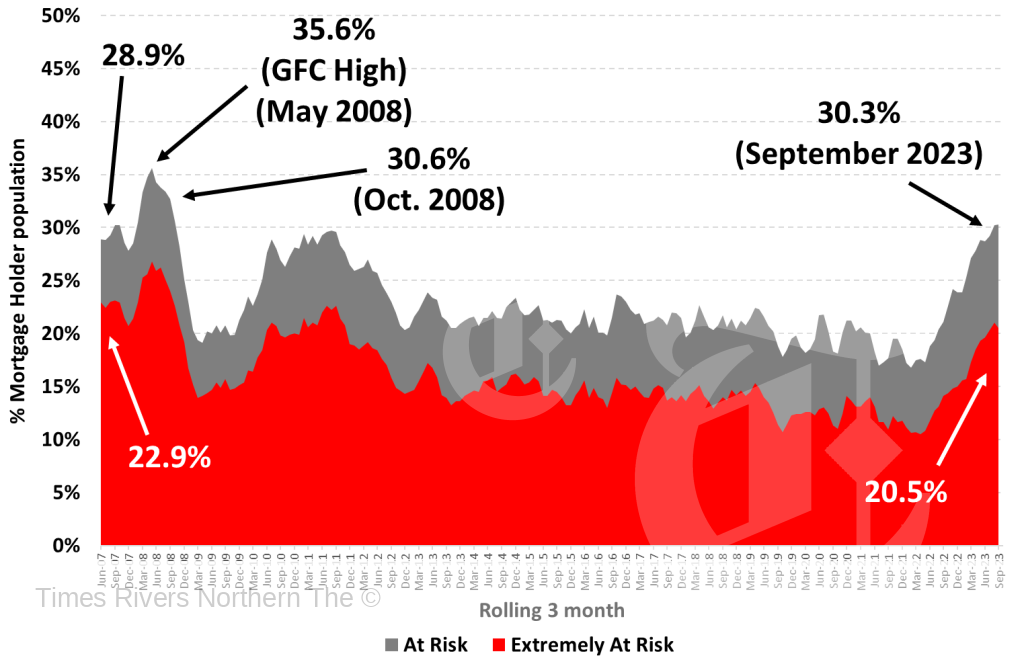

New research from Roy Morgan shows a record high 1,573,000 mortgage holders (30.3%) were ‘At Risk’ of ‘mortgage stress’ in the three months to September 2023. This period encompassed three RBA meetings at which interest rates were left unchanged.

The figures for September represent a new record high, up 7,000 on a month ago.

Over 760,000 more households at risk of mortgage stress after a year of interest rate increases

Advertisements

The number of Australians ‘At Risk’ of mortgage stress has increased by 766,000 since May 2022 when the RBA began a cycle of interest rate increases. Official interest rates are now at 4.1% in October 2023, the highest official interest rates since May 2012, over a decade ago.

The number of Australians ‘At Risk’ of mortgage stress (1,573,000) is at a record high. The proportion of mortgage holders at 30.3% remains below the record highs reached during the Global Financial Crisis of 15 years ago because of the larger size of the Australian mortgage market today. The record high of 35.6% of mortgage holders in mortgage stress was reached in mid-2008.

The number of mortgage holders considered ‘Extremely At Risk’, is now numbered at 1,043,000 (20.5%) which is now significantly above the long-term average over the last 15 years of 15.3%.

Mortgage Stress – Owner-Occupied Mortgage-Holders

Source: Roy Morgan Single Source (Australia), average interviews per 3 month period April 2007 – September 2023, n=2,759.

Base: Australians 14+ with owner occupied home loan.

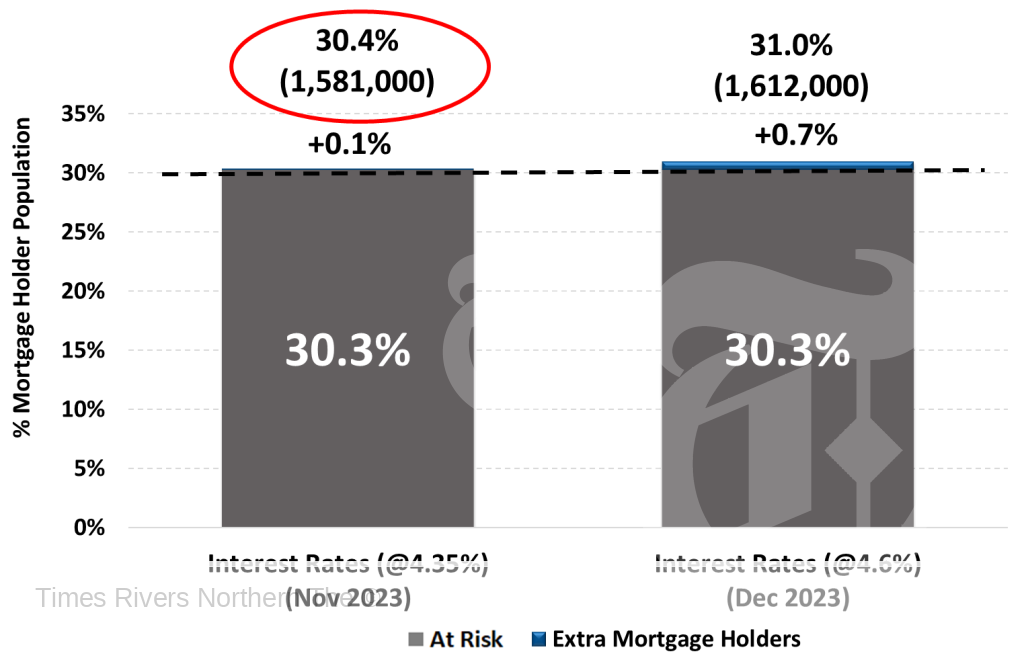

Mortgages ‘At Risk’ set to increase to over 1.58 million if RBA raises rates by +0.25% in November

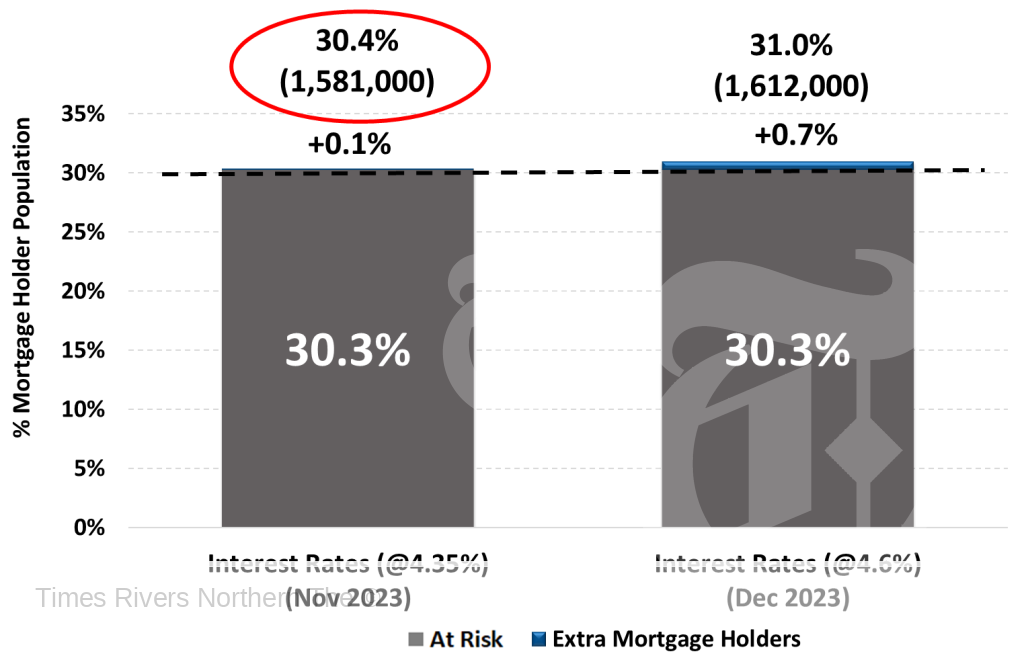

Roy Morgan has modelled the impact of two potential RBA interest rate increases of +0.25% in both November (+0.25% to 4.35%) and December (+0.25% to 4.6%).

In September, 30.3% of mortgage holders, 1,573,000, were considered ‘At Risk’ and this would increase to 30.4% of mortgage holders by November 2023 if the RBA increases interest rates next week.

If the RBA raises interest rates by +0.25% in November to 4.35%, there will be 30.4% (up 0.1% points) of mortgage holders, 1,581,000, considered ‘At Risk’ in November 2023 – an increase of 8,000.

If the RBA raises interest rates by a further +0.25% in December to 4.6%, there will be 31.0% (up 0.7% points) of mortgage holders, 1,612,000, considered ‘At Risk’ in December 2023 – an increase of 39,000.

Mortgage Risk at different level of interest rate increases in November & December 2023

Source: Roy Morgan Single Source (Australia), July – September 2023, n=3,836. Base: Australians 14+ with owner occupied home loan.

How are mortgage holders considered ‘At Risk’ or ‘Extremely At Risk’ determined?

Roy Morgan considers the risk of ‘mortgage stress’ among Mortgage holders in two ways:

Mortgage holders are considered ‘At Risk’ if their mortgage repayments are greater than a certain percentage of household income – depending on income and spending.

Mortgage holders are considered ‘Extremely at Risk’ if even the ‘interest only’ is over a certain proportion of household income.

Unemployment is the key factor which has the largest impact on income and mortgage stress

It is worth understanding that this is a conservative model, essentially assuming all other factors remain the same. The latest Roy Morgan unemployment estimates for September show almost one-in-five Australian workers are either unemployed or under-employed – 2,893,000 (18.9% of the workforce); (‘Real’ unemployment drops to 10.2% in September – now 2.9 million are unemployed (1.6 million) or under-employed (1.3 million)) – an increase of 129,000 (+0.3% points) on a year ago.

While all eyes are on interest rates the greatest impact on an individual, or household’s, ability to pay their mortgage is not interest rates, it’s if they lose their job or main source of income.

New research from Roy Morgan shows a record high 1,573,000 mortgage holders (30.3%) were ‘At Risk’ of ‘mortgage stress’ in the three months to September 2023.

Michele Levine, CEO Roy Morgan, says mortgage stress increased to a new record high in September with 1,573,000 mortgage holders considered ‘At Risk’ of mortgage stress as the RBA’s series of 12 interest rate increases continue to flow through to the wider mortgage market:

“The latest Roy Morgan data shows mortgage stress in the Australian housing market has increased to a new record high of 1,573,000 mortgage holders defined as ‘At Risk’ in September 2023. This represents a substantial increase of 766,000 mortgage holders since the RBA began a record-breaking series of interest rate increases nearly eighteen months ago in May 2022.

“The figures for September 2023 take into account all twelve RBA interest rate increases which lifted official interest rates from 0.1% in May last year to 4.1% by June 2023. Since then, the RBA has decided to leave interest rates unchanged at its last four meetings.

“The RBA’s decision to leave interest rates unchanged in recent months came as inflation decreased compared to earlier this year. However, in recent months inflation has ‘reaccelerated’ and moved upwards. The latest ABS CPI monthly figures for the year to September 2023 show Australian inflation at 5.6%, up 0.4% points from August and up 0.7% points over the last two months.

“This is the first time official inflation has increased for two straight months so far this year – the last time was at the cyclical peak in December 2022 at 8.4%. The increases to inflation are not surprising though considering the increase in energy and fuel prices in recent months.

“The average retail petrol price has averaged above $1.90 per litre for a record 12 straight weeks since early August – beating a previous record run at such a high price in May-July 2022. During mid-2022 Inflation Expectations increased rapidly from 5.3% to 5.9% – up 0.6% points. The latest weekly Inflation Expectations data for mid-October shows the measure at 5.2% for the week to October 29 – up 0.3% points since mid-September and averaging 5.3% over the last four weeks.

“The increases to petrol prices are being driven by a decline in the value of the Australian Dollar which dropped below 63 US cents in mid-October to its lowest since November 2022. As long as the Australian Dollar stays low, and petrol prices stay high and even increase further, there will be additional inflationary pressures in the economy.

“These pressures are adding to calls for the RBA to raise interest rates again and are a key factor for why we have modelled two further interest rate increases. If the RBA does raise interest rates next week by 0.25%, Roy Morgan forecasts mortgage stress is set to increase to over 1.58 million mortgage holders (30.4%) considered ‘At Risk’.

“Of even more concern is the rise in mortgage holders considered ‘Extremely At Risk’, now estimated at 1,043,000 in September 2023. This figure has more than doubled since the RBA began raising interest rates, representing an increase of over 560,000 mortgage holders.

“When considering the data on mortgage stress, it is always important to appreciate interest rates are only one of the variables that determines whether a mortgage holder is considered ‘At Risk’. The variable that has the largest impact on whether a borrower falls into the ‘At Risk’ category is related to household income – which is directly related to employment.

“The latest figures on mortgage stress show that rising interest rates are causing a large increase in the number of mortgage holders considered ‘At Risk’ and further increases will spike these numbers even further. If there is a sharp rise in unemployment, mortgage stress is set to increase even more.”

These are the latest findings from Roy Morgan’s Single Source Survey, based on in-depth interviews conducted with over 60,000 Australians each year including over 10,000 owner-occupied mortgage-holders.

For more real estate news, click here.

Tweed Shire News2 years ago

Tweed Shire News2 years ago

Motoring News1 year ago

Motoring News1 year ago

COVID-19 Northern Rivers News3 years ago

COVID-19 Northern Rivers News3 years ago

COVID-19 Northern Rivers News3 years ago

COVID-19 Northern Rivers News3 years ago

Northern Rivers Local News3 years ago

Northern Rivers Local News3 years ago

Health News3 years ago

Health News3 years ago

COVID-19 Northern Rivers News3 years ago

COVID-19 Northern Rivers News3 years ago

NSW Breaking News3 years ago

NSW Breaking News3 years ago