Business News

Win-win: Feeding hungry people while helping the environment

Win-win: Feeding hungry people while helping the environment

By Samantha Elley

Up to 40% of food purchased by restaurants, cafes and other foodservice businesses ends up in the bin.

With that statistic in mind Foodbank and Y Waste have teamed up to find a better way for food businesses to give worth to their waste and provide meals for people who might otherwise go without.

Arianne Schreiber runs Yummify, a catering company located in the Byron Bay Industrial Estate which has registered to use the Y Waste app to offer food left over from an event.

She provides organic, vegan and mainly gluten free catering for retreats, events, home deliveries and at the Mullumbimby markets.

“I’m very committed to zero waste and plastic free,” said Ms Schreiber.

“I’m committed to organic biodynamic and growing regeneratively, so joining the app was a no-brainer.

“I specifically try to know how much I’m cooking and make as least waste as possible with food, but sometimes there are leftovers that people have taken home.

“But having somewhere where you can offer it cheaper, it’s a no-brainer.”

Ms Schreiber is already practicing low waste. At the end of the day at the markets, her leftover food is marked to half price to ensure she takes no extras home.

The app will now help her to reach more people locally, and hopefully provide some yummy dishes like her eggplant parmigiana and Zucchini Spaghetti Napoli to those who need it and not in the bin.

Through Foodbank, local charities connect and identify vulnerable people who live in the area and need assistance.

They can then log on and find local offers nearby and claim them with dignity just like any takeaway meal, according to Ian Price, the founder of Y Waste.

“Ninety percent of the food outlets we’ve spoken to want to donate meals in their communities and the indication is that over half of all the meals being offered through Y Waste will end up with people who can’t afford to buy them,” he said.

After a successful trial of the concept, Foodbank and Y Waste are now turning their attention to the Northern Rivers Region as the place to launch the initiative, thanks to a project funded by the NSW Environment Protection Authority and the Fight Food Waste Cooperative Research Centre.

Aside from Yummify, other Northern Rivers food places that have registered so far are Elixiba of Byron Bay and Flock Espresso of Lismore.

Foodbank and Y Waste are now looking for local restaurants, cafes and takeaways to register.

The registration process takes only a few minutes, and the app takes care of notifications, receipts and is free to use with no contract or minimum term.

When registered, businesses can save on waste disposal, help the environment and help genuine people facing hardship.

More information can be found at the website www.foodbank.org.au/y-waste.

Captions for photos

Foodbank 1 -3: Flock Espresso Cafe, Lismore. Photo: Samantha Elley

Foodbank 4 Vegan dish Zucchini Spaghetti Napoli made by Yummify. Photo contributed

Business News

Gold Coast Emerges as Economic Powerhouse Outpacing Nation’s Capitals

Business News

Business Closures Reach Four-Year High Amid Cost Pressures

Business News

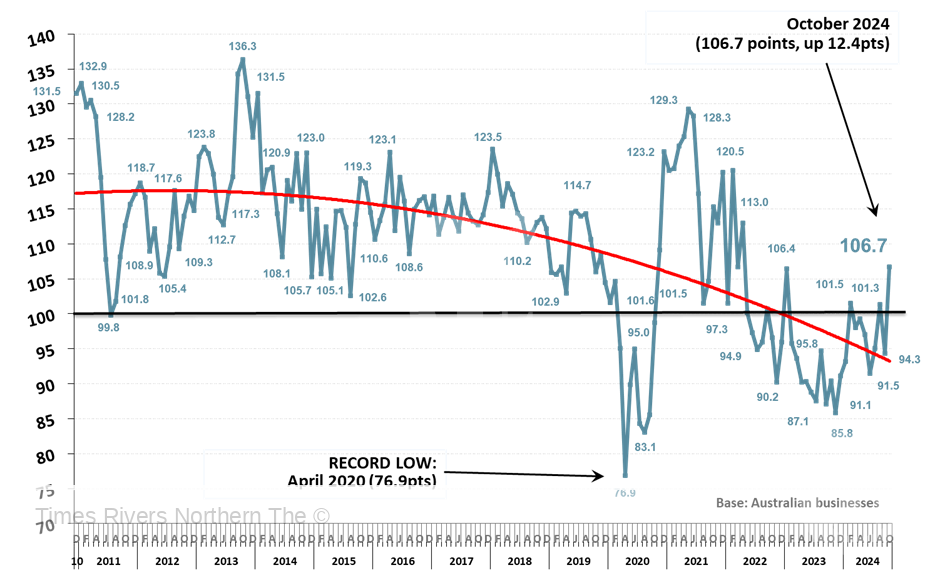

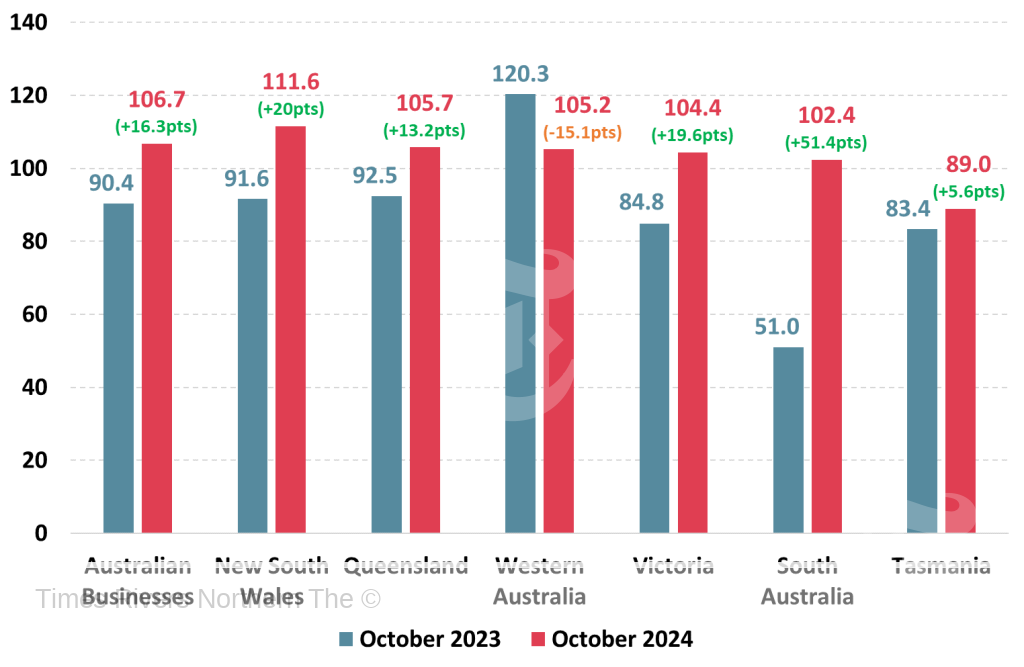

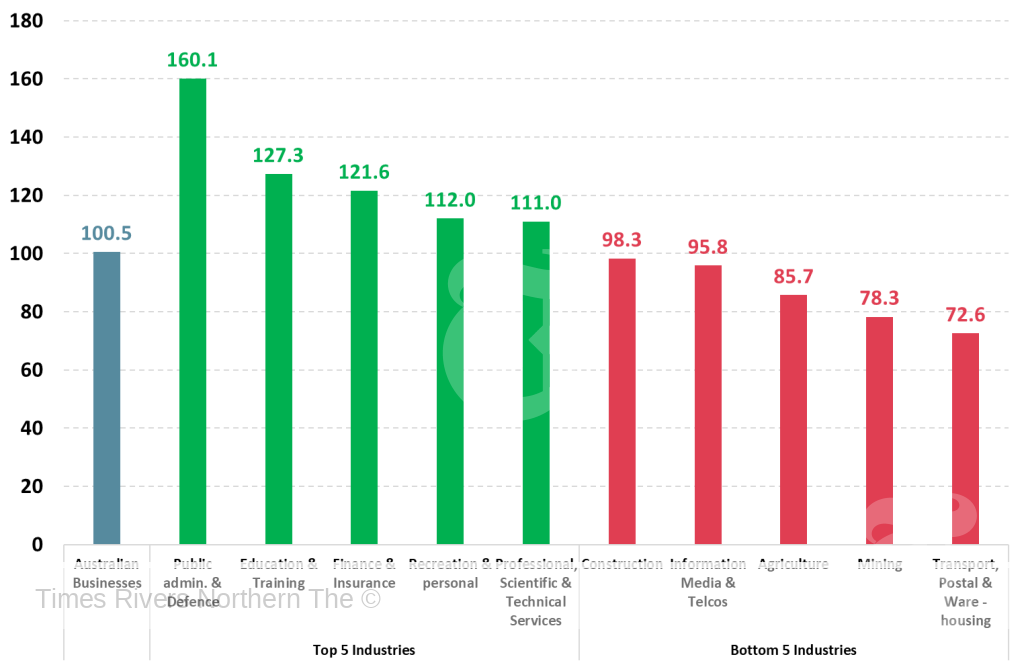

Business Confidence Surges as Inflation Declines, Hitting a Two-Year High

-

Tweed Shire News2 years ago

Tweed Shire News2 years agoA NEW TWEED HEADS

-

Motoring News2 years ago

Motoring News2 years agoToyota Supra: Get Ready For A Fully Electric Version In 2025

-

COVID-19 Northern Rivers News3 years ago

COVID-19 Northern Rivers News3 years agoNorthern Rivers Local Health District COVID-19 update

-

COVID-19 Northern Rivers News3 years ago

COVID-19 Northern Rivers News3 years agoNorthern Rivers COVID-19 update

-

Northern Rivers Local News3 years ago

Northern Rivers Local News3 years agoFears proposed residential tower will ‘obliterate’ Tweed neighbourhood’s amenity and charm

-

Health News4 years ago

Health News4 years agoCOVID-19 Vaccination Clinic now open at Lismore Square

-

COVID-19 Northern Rivers News3 years ago

COVID-19 Northern Rivers News3 years agoLismore Family Medical Practice employee close contact

-

NSW Breaking News3 years ago

NSW Breaking News3 years agoVale: Former NSW prison boss Ron Woodham