$10 Million for Australian Wine and Cider Businesses

The Australian Government has responded to the challenges faced by the wine industry in recent times, with the announcement of a $10 million grant for more than 200 wine and cider businesses through the Wine Tourism and Cellar Door Grant Program.

This program is supported by the Albanese Government and administered by Wine Australia. It has been designed to help businesses attract visitors to the various wine regions of Australia, as well as promote agri tourism. The grant is distributed directly to wine and cider businesses and awarded up to $100,000.

This fourth round of funding has seen 79 South Australian businesses, 45 Victorian businesses, 35 New South Wales businesses, 32 Western Australian businesses, 9 Tasmanian businesses and 2 Queensland businesses receive grants.

Advertisements

Speaking at Barristers Block Winery in the Adelaide Hills, Minister for Agriculture, Fisheries and Forestry Murray Watt acknowledged the contribution of Australia’s grape and wine sector to the economic prosperity of the country, particularly in regional areas.

He noted the resilience of the sector, and said the grant funding would help with its recovery. Family owner of Barristers Block, Lachlan Allan, said the grant would help them to bring forward their planned revamp of their cellar door. He noted that they had plans to improve their tasting experiences, as well as upgrade their cellar door infrastructure, from small improvements such as new tables and chairs, to larger investments towards business planning.

Lee McLean, Chief Executive Officer of Australian Grape & Wine, noted the benefits of cellar door tourism and the flow on effects it has to other local businesses, such as pubs, bakeries and petrol stations. He said the grant would help drive investment in more world-class tourism experiences, drawing visitors to regional Australia and underpinning employment and economic growth in the sector. The Wine Tourism and Cellar Door Grant Program is part of a larger effort by the Government to assist the wine industry.

Through the Agricultural Trade and Market Access Cooperation program, grants totalling $2.815 million were awarded to Australian Grape and Wine to explore new markets, and a $500,000 grant was awarded to the Food and Wine Collaboration Group to assist with its programs.

The Wine Tourism and Cellar Door Grant Program is helping to drive investment in infrastructure and business planning, as well as attract visitors to the various wine regions of the country. It is just one of the measures the Australian Government has taken to ensure the continuing success of the wine industry.

Points of Interest:

- The Australian Government has provided $10 million in grant funding to more than 200 wine and cider businesses through the Wine Tourism and Cellar Door Grant Program.

- This grant is distributed directly to wine and cider businesses and awarded up to $100,000.

- The grant will help businesses attract visitors to the various wine regions of Australia, as well as promote Agri tourism and draw visitors to regional Australia.

Government Funds $10 Million for Aussie Wine and Cider Industries

The Australian wine industry has been especially hard hit by global developments, such as changing consumer tastes, competition from other winemakers, and tariffs on exports.

In response to this, the Government recently announced a $10 million grant, distributed directly to wine and cider businesses and awarded up to $100,000, through the Wine Tourism and Cellar Door Grant Program. This program is administered by Wine Australia and is supported by the Albanese Government, who believes it will help to promote agri-tourism and attract visitors to Australia’s many wine regions.

This fourth round of funding has seen an amazing 206 businesses benefit from the grant, allowing them to invest in infrastructure, business planning, and enhance their cellar door tasting experiences. Speaking at Barristers Block Winery in South Australia, Minister for Agriculture, Fisheries and Forestry Mr. Murray Watt praised the contribution of the grape and wine sector to the country’s economy, noting that it has been especially beneficial for regional areas.

He acknowledged the sector’s resilience, and expressed his hope that this grant funding will aid its recovery. Lee McLean, Chief Executive Officer of Australian Grape & Wine, believes that cellar door tourism can have a huge flow-on effect to other local businesses, and with more support, will be able to help drive investment in world-class tourism experiences. The Wine Tourism and Cellar Door Grant Program is just one way in which the Australian Government is supporting the wine industry.

The Agricultural Trade and Market Access Cooperation program provided $2.815 million in grants to Australian Grape and Wine to explore new markets, and a $500,000 grant was awarded to the Food and Wine Collaboration Group to assist with its programs. Government assistance is helping to drive investment in infrastructure and business planning for wine and cider businesses, as well as attract visitors to our many stunning wine regions. These measures, along with the resilience of the sector, will ensure the continuing success of the Australian wine industry.

Tweed Shire News2 years ago

Tweed Shire News2 years ago

Motoring News1 year ago

Motoring News1 year ago

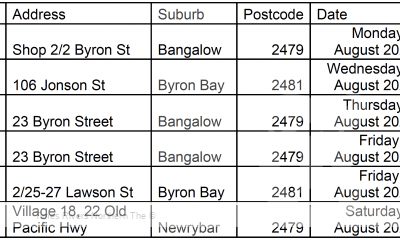

COVID-19 Northern Rivers News3 years ago

COVID-19 Northern Rivers News3 years ago

COVID-19 Northern Rivers News3 years ago

COVID-19 Northern Rivers News3 years ago

Northern Rivers Local News3 years ago

Northern Rivers Local News3 years ago

Health News3 years ago

Health News3 years ago

COVID-19 Northern Rivers News3 years ago

COVID-19 Northern Rivers News3 years ago

NSW Breaking News3 years ago

NSW Breaking News3 years ago