Housing Policy Disaster: Property Approaches a Tipping Point

Experts predict the end of 20 per cent plus rent hikes, but the rental crisis is expected to persist as tenants compete for limited properties.

The Australian rental market is at a critical juncture. Vacancy rates have edged higher, and the pace of rental growth has slowed, but relief for renters remains distant. According to SQM Research, Australia’s rental vacancy rate increased slightly to 1.3 per cent in June from 1.2 per cent in May. Sydney’s vacancy rate rose to 1.7 per cent, Melbourne to 1.5 per cent, Brisbane to 1.1 per cent, and Perth to 0.8 per cent.

Although still a landlord’s market, SQM Research managing director Louis Christopher noted a shift. Historically, rental vacancies increase in June due to a winter lull, but this seasonal effect disappeared in 2021 and 2022. “The fact that this year we’ve recorded a seasonal increase suggests the rental market is starting to return to more normal activity levels,” he said. Christopher is confident that the era of 10 to 20 per cent annual rental increases is ending.

Tenants have responded to soaring rents by sharing housing, relocating to regional areas, or buying their first homes. This has been factored into current rents, leading Christopher to predict that future rent increases will align more closely with inflation trends.

Despite this, the rental market remains in severe shortage and is unlikely to materially soften for several years. A slight increase in vacancy rates in Sydney, Melbourne, Canberra, and Brisbane’s CBDs indicates that student demand for rental accommodation may have peaked, with migration rates expected to slow.

Dr. Peter Tulip, chief economist at the Centre for Independent Studies, agrees that the rent boom is tapering off but emphasises that the crisis continues. “Vacancies are unusually low, and the rental market remains extremely tight,” he said. He expects rents to continue rising faster than other prices and incomes, presenting a grim outlook for renters. “We have a housing policy disaster in this country, and it’s going to get worse,” he warned.

Tulip supports the NSW government’s push for more housing, especially around train lines, and calls for other governments to adopt similar measures. Despite a slight improvement, he insists that shortages remain significant.

Dr. Nicola Powell, Domain’s chief of research and economics, noted that the rental market began to turn a corner several months ago but will take longer to fully rebalance. “The vacancy rate has been nudging higher, and the pace of rental growth has slowed,” she said. Powell believes the 20 per cent annual rent increases are over.

In the June quarter, Sydney’s house rents held steady for the first time in 18 months, while Melbourne’s house rent growth was the lowest since March 2023. Powell points out that net overseas migration remains high but is decreasing, investors are returning, and households are adjusting by moving into shared housing or back with parents. “It is technically still a landlord’s market across Australia, but rental price growth has stabilised over the quarter,” she said. “The affordability ceiling hasn’t been reached; it’s been smashed.”

For more real estate news, click here.

Tweed Shire News2 years ago

Tweed Shire News2 years ago

Motoring News1 year ago

Motoring News1 year ago

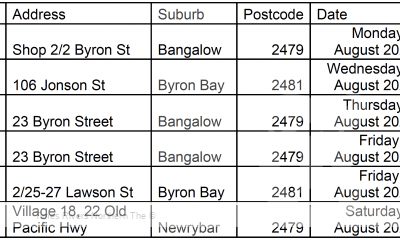

COVID-19 Northern Rivers News3 years ago

COVID-19 Northern Rivers News3 years ago

COVID-19 Northern Rivers News3 years ago

COVID-19 Northern Rivers News3 years ago

Northern Rivers Local News3 years ago

Northern Rivers Local News3 years ago

Health News3 years ago

Health News3 years ago

COVID-19 Northern Rivers News3 years ago

COVID-19 Northern Rivers News3 years ago

NSW Breaking News3 years ago

NSW Breaking News3 years ago