new SCHOLARSHIPS for women TO build careers in construction

The Institute of Applied Technology – Construction (IATC) has announced three new microskills to its suite of courses as well as fee-free training places for women.

The Institute is a partnership between TAFE NSW, leading construction company CPB Contractors, and Western Sydney University.

Co-designed with industry experts, microskills are online, bite-sized, self-directed courses. These three new microskills focus on topics critical for building capability in the construction sector now and into the future and include: Introduction to Women in Construction, Introduction to Sustainability in Construction, and The Role of Building Information Modelling (BIM) in Construction.

Advertisements

The IATC is also furthering its commitment to encourage more women to kickstart a career in construction or upskill in their current role with the availability of 60 fee-free training places in its microcredential courses. The scholarships come at a time when the construction industry in Australia is facing a shortage of over 100,000 workers.

Applications are now open for the Women in Construction Scholarships, delivered by the Institute of Applied Technology Construction.

CPB Contractors General Manager Infrastructure NSW and ACT, Rob Monaci said, “As the pipeline of infrastructure continues to grow, particularly with the focus on housing and new energy, the need for more skilled workers is an industry-wide issue. We need to be doing more to attract people at all stages of their careers to transition into fulfilling careers in construction, particularly women.”

The microcredentials take eight weeks to complete and provide industry-specific skills recognised as evidence of competence. The microcredentials can be completed online or face-to-face.

Women in Construction Scholarship courses are aimed at high-growth areas and include:

- Project Management Foundations in Construction

- Introduction to Project Scope Management in Construction

- Project Risk Management in Construction

- Stakeholder Engagement and Management in Construction

- Quality Management in Construction

- 2D CAD Drawings and 3D Models in Construction

- Introduction to Building Information Modelling (BIM) in Construction

- Microsoft Office Foundations in Construction; and

- Power BI Fundamentals in Construction

Director Operations Institutes of Applied Technology Helen Fremlin encouraged women interested in a career in construction to take advantage of the free microcredentials and said they promote a practical learning journey.

“Whether you choose online or face-to-face, these microcredentials include regular educator-led sessions. These draw on industry specific examples, tasks, and case studies to give students the opportunity to apply their knowledge and skills directly with the support of educators.

“Part of the eligibility process requires women to complete two microskill courses. Microskills are free, two-hour, self-directed sessions, a great way to help get you started.”

CPB Contractors’ Rob Monaci added, “The introduction of these three new Microskills focused on women, sustainability and BIM are really exciting as not only are they critical to the future of our industry, but they are also compelling in attracting new entrants to the workforce who are passionate about the role diversity, sustainability and digital technology plays in building the game changing infrastructure projects set to roll out across our cities and regions,” said Mr Monaci.

Western Sydney University Interim Vice-Chancellor and President, Professor Clare Pollock, said the suite of microskills and microcredential courses and scholarships will empower women in construction and will help to meet Australia’s workforce needs.

“The University has a proud history of opening up educational opportunities for students including talented women in our region. These innovative microskills and microcredentials will help students upskill and take advantage of skilled job opportunities in the fast-growing construction sector,” said Professor Pollock.

“Western Sydney University is pleased to partner with TAFE NSW and CPB Contractors to co-develop and co-deliver courses that integrate research-led learning with advanced technical and industry-based skills while boosting diversity in the sector.”

Successful applicants will be offered a pre-class connection session to meet other women and visit a construction site in Sydney.

TAFE NSW and Training Services NSW are also inviting young women in schools and parents across the state to register for a Girls in Trades virtual event on the 22nd of May. Participants will learn about different careers and study pathways for young women to consider in construction and non-traditional trades.

For more business news, click here.

Tweed Shire News2 years ago

Tweed Shire News2 years ago

Motoring News1 year ago

Motoring News1 year ago

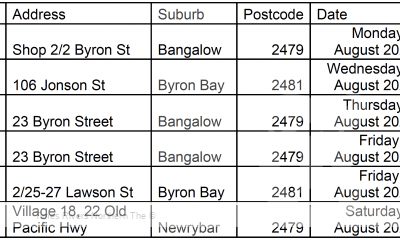

COVID-19 Northern Rivers News3 years ago

COVID-19 Northern Rivers News3 years ago

COVID-19 Northern Rivers News3 years ago

COVID-19 Northern Rivers News3 years ago

Northern Rivers Local News3 years ago

Northern Rivers Local News3 years ago

Health News3 years ago

Health News3 years ago

COVID-19 Northern Rivers News3 years ago

COVID-19 Northern Rivers News3 years ago

NSW Breaking News3 years ago

NSW Breaking News3 years ago