DICK AND LEILA BEATTIE – CASINO – Part One

By Helen Trustum

When talking with Dick and Leila on the 6th February 2024 I realised that my initial intention of researching a story from Leila’s early days also required a story that unfolded about her husband Dick.

Richard William George (known as Dick) was born on 22nd February 1932 to parents Stan and Mary Beattie at Stockton. Dick’s Grandfather, Edward Beattie was a boat builder and even in his 80’s still worked building boats, including fishing vessels and ferries. His Great Uncle Gordon Beattie was one of the men that built the passenger ferry that ran between Yamba and Iluka. Dick’s father Stan was a boiler maker with BHP.

Dick went to Primary school at Stockton then on to New Castle Boys High School. He later studied at the University of New England in Armidale before completing his Honours Degree at the University of Sydney.

Family of Stan and Mary’s: Dick and Gloria.

Leila with her calf

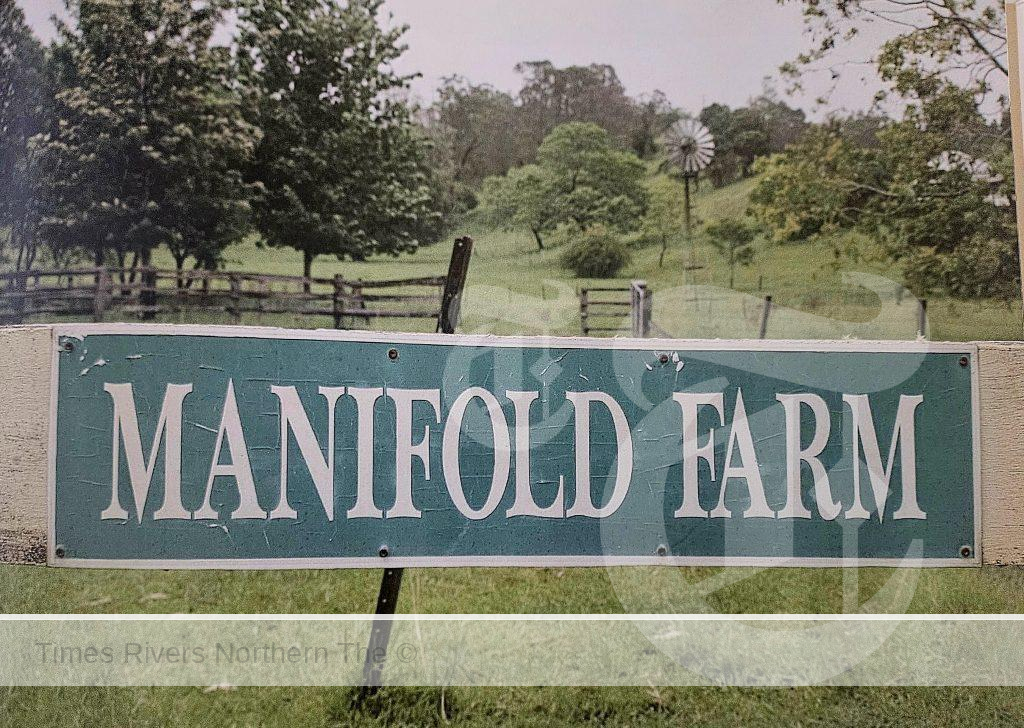

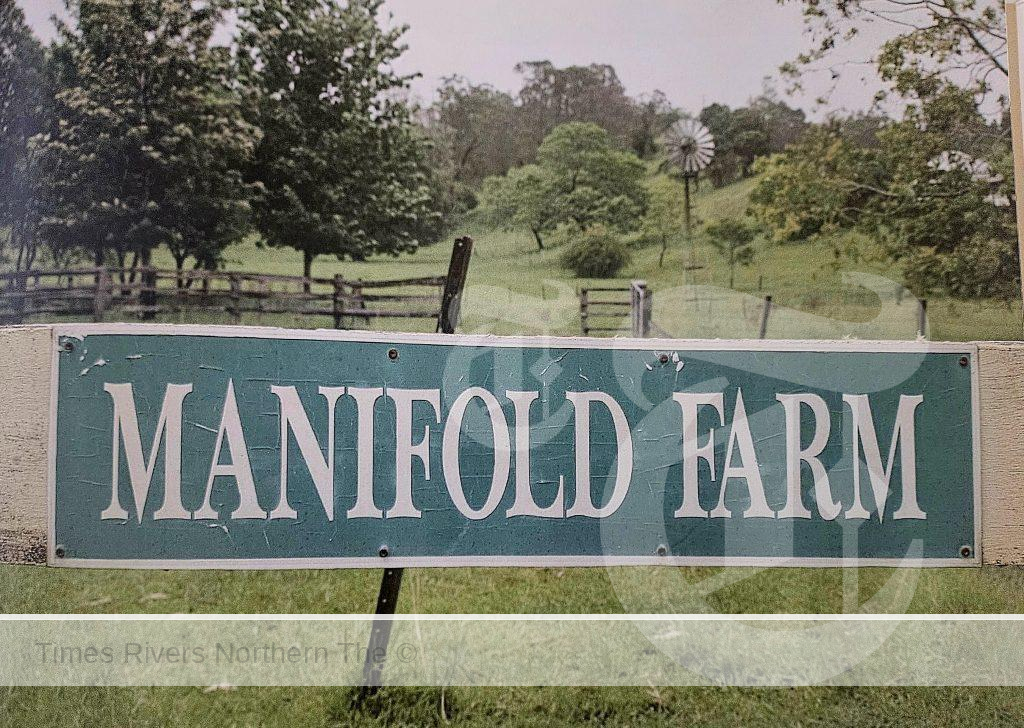

Leila was born Leila Madge Roberts in Casino on 10th September 1931 to parents Donald and Madge Roberts who were living on “Manifold Farm”, Bentley.

Family of Donald and Madge Roberts: Eileen, Leila and Nelda. The family lost little Nelda with whooping cough at the age of two and half years.

Donald was born at Cowra NSW and at the age of 14 years moved with his parents to Dunoon. They later relocated to Mongogarie from where Don enlisted in World War 1 in December 1915. He arrived at the Military Camp in Tell EL Kebir, Egypt in May 1916. After training in England, Don was transferred to France where he performed 10 days of training in the infamous “Bull Ring”, training camp on the dunes between Etaples and Camiers, near Boulogne, before joining the 31st Battalion at Armentieres.

Shortly after joining the 31st Battalion, Don was attached to the transport section, where his reputation as an excellent horseman had become known. The 31st transport section contained a number of top horsemen. Alongside Don was Gus Hosking, also from Mongogarie. They were both reputed to be the best. Don and Gus were sent to Abbeville, where the commandant of the riding school, became so impressed that he gave them the honour of leading the column of artillery on parades.

Don and Madge Roberts

Don served with distinction in the unit and was made sergeant shortly after joining it. The work of getting supplies through to the front line, units was difficult and dangerous, most of the hauling being done at night. Don was awarded the Croix de Guerre (Belgium).

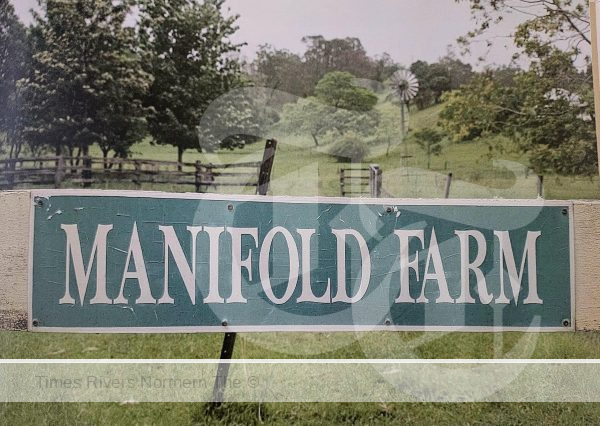

Returning from the War, Don married Madge Collison and worked at the Coombell Brick Works before settling on Lot 12 on the Runnymede Soldiers Settlement, calling the property “Manifold Farm”. This settlement came about when the owner of Runnymede Station, James Chester Manifold, gave three thousand acres of rich scrub land on the eastern side of the station, to be developed into twenty dairy farms. The farms were to be made available, by ballot, to ex – servicemen from Tomki Shire (now part of Richmond Valley Shire) and Kyogle Shire. James Chester died in 1918. His son Thomas Chester Manifold inherited Runnymede and keenly supported the scheme. These twenty farms with applicants were required to pay three hundred and twenty – one pounds ($640) for the improvements on the farms. They received a Life Estate Title. Now in 2024 there are five families from the original residents still on their block of ground.

Don also enlisted in the army in World War 11 and was in camp at Goonoo Goonoo Station, near Tamworth. After a while he left the army and returned to Bentley where he organized the local V.D.C. (Volunteer Defence Corps). Since there was a shortage of rifles they drilled with wooden rifles until they were properly equipped. Later a firing range was established on the property at Bentley. While in the V.D.C Don was promoted to the rank of Captain.

House at Bentley

Don was one of the many farmers in the district who had Italian P.O.W.’s working on the property towards the end of the War. He also served as bushfire brigade captain and was involved with the Bentley Hall Committee. Madge supported her husband in his community involvement and took over running the farm while he was away.

In 1929 a school was built on land donated by Charlie Beck, from the Manifold Settlement. The school was called Manifold Public School and is still operating today. Both Eileen and Leila went to school at Manifold. Leila remembers attending school and talks readily about it. On her first day at school Leila arrived with a bunch of flowers for the teacher Mr Charlie Steele. The flowers were from her mother’s garden. Madge excelled in nurturing floral beauty.

Leila rode a horse to school called “Creamy”. The older boys would catch “Creamy” and saddle her and have her ready for Leila to ride home. Leila competed in athletics and interschool sports day. Hockey was played on Becks flat. Hockey sticks could not be purchased so the children had to scout around and find a lantana stick with a bend at one end. A tin can was used as a ball.

Manifold Farm at Bentley

Leila remembers Mr Steele taking the children up towards Boundary Creek into the forest to cut lawyer cane (Calamus Australis). The fibre was used at school, teaching the children weaving baskets. There were over 50 children that attended the school at one time: – All in one room – 1st to 6th class. Long desks and seating stools were used. Children from the families that Leila remembers at the time she attended were Owen Casey, Bob Knapp, Bill Moore, Jack Doman and family names Armstrong, Bulmer, Ball, Doman, Knapp, Hartley, Moroney and Childs. Mrs Steele, wife of teacher Charlie, taught the girls sewing in the weather shed once a week.

Leila has many memories of those days when on Sundays, tennis would be played over on the Moroney family’s property and meeting up with her friends the Moroney girls, Joyce and Clare. Cricket would also be played with a picnic lunch. Leila loved the dances held in the Bentley Hall where Hillary and Leila Doohan from Back Creek would be the musicians playing.

To be Continued

For more rural news, click here.

Tweed Shire News2 years ago

Tweed Shire News2 years ago

Motoring News1 year ago

Motoring News1 year ago

COVID-19 Northern Rivers News3 years ago

COVID-19 Northern Rivers News3 years ago

COVID-19 Northern Rivers News3 years ago

COVID-19 Northern Rivers News3 years ago

Northern Rivers Local News2 years ago

Northern Rivers Local News2 years ago

Health News3 years ago

Health News3 years ago

COVID-19 Northern Rivers News3 years ago

COVID-19 Northern Rivers News3 years ago

NSW Breaking News3 years ago

NSW Breaking News3 years ago