Australia’s $1.9b of carbon farming to reduce emissions

Qld, NSW lead charge on $1.9b carbon farming contracts to reduce emissions

Queensland and NSW are the major beneficiaries of $1.9 billion of land sector emissions reduction contracted by the Commonwealth Government as the carbon farming industry seeks to play a greater role in growing jobs and investment while assisting the transition to net-zero emissions, said the Carbon Market Institute (CMI) today.

There are signs corporate demand to purchase emissions reduction may be increasing to fund compliance and carbon offsetting needs. But since the repeal of the carbon pricing mechanism in 2014, the Commonwealth has been the dominant purchaser through the Emission Reduction Fund (ERF).

CMI has analysed Clean Energy Regulator data of the ERF’s contracted abatement in the land sector, otherwise known as carbon farming.

It found there are 392 single-state carbon farming projects across Australia* contracted to generate at least $1.9 billion over 16 years.

Projects include activities protecting or regenerating native forests, managing bushfires in Australia’s savanna to avoid late season high intensity burns, capturing and destroying the methane from effluent waste at piggeries and building soil carbon through changed farming practices.

Queensland is leading the charge with 129 projects worth $794.9 million, and NSW is right behind with 159 projects worth $728.7 million.

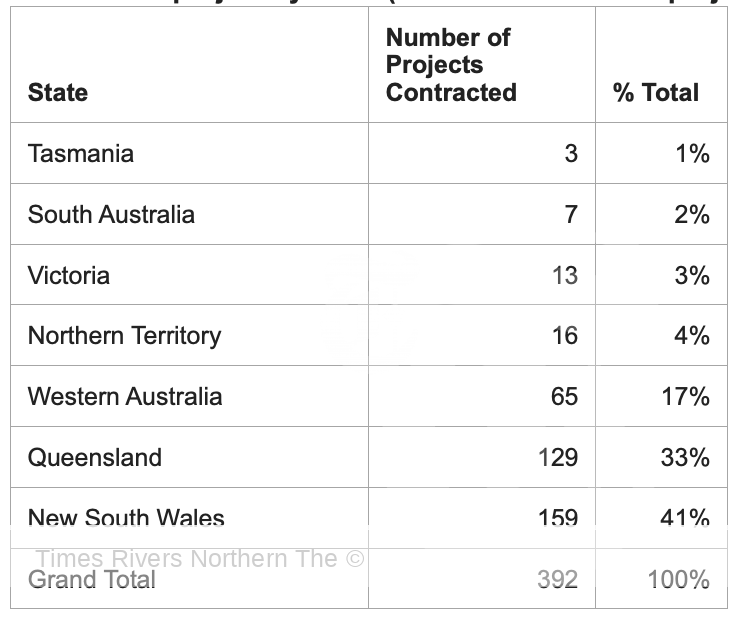

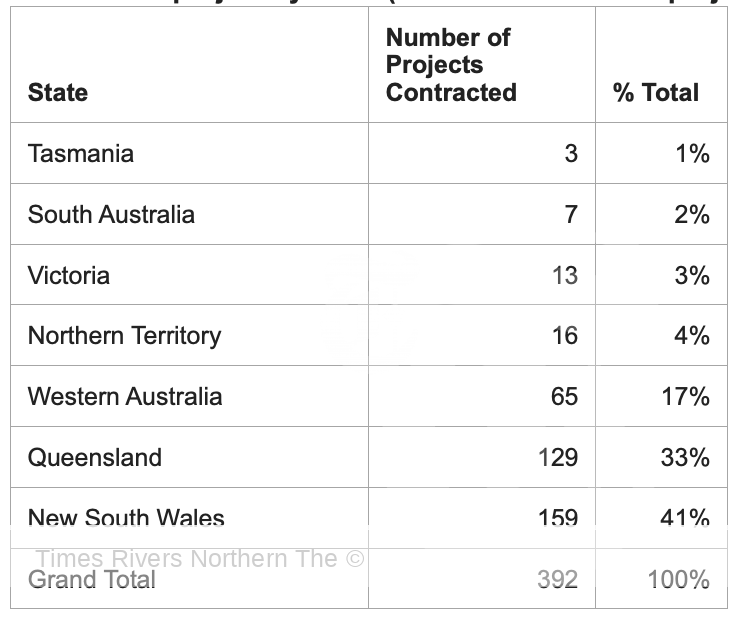

Land-based project by State (excludes multi-state projects)

Land-based project by State

Value of land-based projects by State (excludes multi-state projects)

The findings come as Australia’s carbon farming industry prepares to discuss plans to urgently scale-up jobs and investment, while maintaining integrity, at the CMI’s 5th annual Carbon Farming Industry Forum today (10 September) and next Friday (17 September)**.

CMI CEO John Connor said:

“Carbon farming is a vital new agricultural opportunity to help Australia achieve net-zero emissions before 2050, it is adding extra commodity revenue streams for farmers and assisting international market access for agricultural and other export industries.

“Since the repeal of the carbon pricing mechanism, the ERF has ensured the survival of this fledgling industry with Queensland and NSW being the major beneficiaries followed by Western Australia. Other states are moving to develop carbon farming sectors.

“While the ERF has been the major driver of carbon farming in the last half decade, the 2020s will likely see the expansion of voluntary and compliance corporate activity. Carbon farming needs to grow alongside decarbonisation initiatives to achieve urgent emission reductions and it needs to do so with high integrity and transparency.

“These will be the issues focused on today at the first day of the 5th Carbon Farming Industry Forum. Next Friday’s sessions will focus on carbon farming’s additional social and environmental benefits, as well as the importance to agriculture of carbon as a revenue stream and as a means of assisting to demonstrate the sustainability of agricultural products to export and domestic markets.”

GreenCollar Chief Commercial Officer Dave Moore said:

“Carbon farming projects not only have economic benefits, but also environmental and social impacts.

“We’ve got a really good opportunity in Australia given our landmass and our mature offset scheme, that we can drive quite significant investment into regional communities with job creation, training opportunities and farming infrastructure investment.

“There’s also a good opportunity to bring Traditional Owners and local communities much more fairly into the centre of conversations around projects – listening to them and taking on board what they want to see in these projects.”

Tweed Shire News2 years ago

Tweed Shire News2 years ago

Motoring News2 years ago

Motoring News2 years ago

COVID-19 Northern Rivers News3 years ago

COVID-19 Northern Rivers News3 years ago

COVID-19 Northern Rivers News3 years ago

COVID-19 Northern Rivers News3 years ago

Northern Rivers Local News3 years ago

Northern Rivers Local News3 years ago

Health News3 years ago

Health News3 years ago

COVID-19 Northern Rivers News3 years ago

COVID-19 Northern Rivers News3 years ago

NSW Breaking News3 years ago

NSW Breaking News3 years ago