BROADWATER FERRY

The history of Broadwater has largely revolved around the sugar mill. In 1863 Henry Cooke and Alexander McDonald became the first people to select land in the area. To begin with, sugar was grown and crushed on the small private farms in the region. The CSR opened the Broadwater Sugar Mill in 1880.

Broadwater is a small town in the Richmond Valley on the Richmond River. In 1978 CSR sold the mill to the newly formed New South Wales Sugar Milling Co-operative, which established its head office in Broadwater. Before Broadwater was named it was called “McDonald Town”.

In 1993 there was concern over the Red Azolla Weed that was infesting the Richmond and Wilsons River. The plant that was like a fern was dumped at the top reaches of the Wilsons River and the recent rain moved the infestation down river as far as Empire Vale. This weed was playing havoc with the wire ropes that guided the ferry across the river. Every now and again the ferry would have to stop and clear the weed off the wire ropes.

Floodwater has always been a problem to Broadwater due to the local catchment low gradient floodplain. Filling up in Tuckean Swamp, was the result of Wilsons River breaking its banks at Tuckurimba and spreading out across the farmland. This floods the area across the river from Broadwater around Dungarubba and Bagotville. Floodwater then flows downstream to Broadwater.

Hauling Cane by barge to the Broadwater Sugar Mill – 1965

Richmond River Herald – 12/7/1912

At the last meeting of the Tintenbar Shire Council they were setting out the estimated cost of establishing and maintaining – a ferry at Broadwater.

- Hand -geared punt – 28 feet by 12 feet – £250

- Wire Rope – £50

- Piles for guide – £50

- Ferry Boat – £18

- Incidentals – £18

- Total – £368

Cr. Whipps suggested that Gundurimba Shire be asked to go in with a share of the coast as it is on the boundary of two councils. The approaches to the ferry were causing a little concern as they would continually silt up, even after dredging.

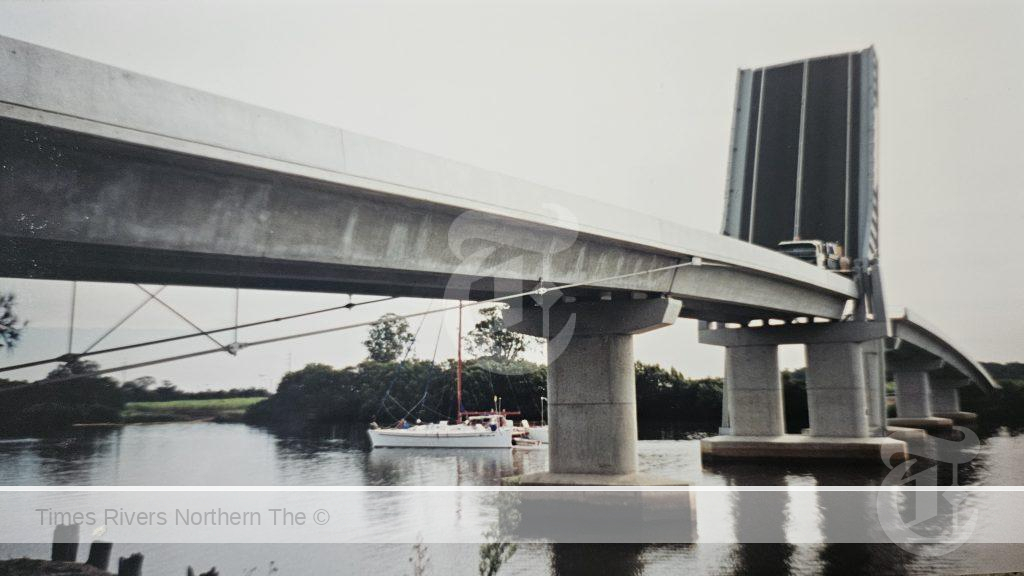

For years a bridge was discussed. Then in 2001 their dreams come true. With help of $500,000 over ten years toward the cost from Lismore City Council (on the north side) and Richmond Valley Council (on the south side) kicked in $250,000 each on top of the $1,4m from the Federal Government. Coincidentally, the bridge was officially opened the day the NSW sugar cane harvest started. The bridge’s centre span lifts to allow high-mastered craft through.

Deputy Prime Minister Mr John Anderson, Mr Ian Causley, Mayor of Lismore Mr Bob Gates and Mayor of Richmond Valley Council Mr Col Sullivan at the Opening of Broadwater Bridge – 13 – 6 2001

Deputy Prime Minister and Minster for Transport, John Anderson, cut the ribbon and unveiled the plaque to link the northern and southern sides of the Richmond River with a $3,000,000 structure, replacing a six-car ferry. It was a proud day for Co-operative chairman, Jim Sneesby, as he stood in the middle of the six-span structure and only a couple of kilometres from his own cane farm.

A very proud man on that day 3rd June 2001, was 102 years old, Peter Bolton from Broadwater. Peter was a special guest. He remembered those early days of the ferry when it had to be winched across the river. He had lived in Broadwater all his life.

Now with the new highway stretching along the New South Wales Coast another bridge has surfaced. It is 980 metres long and the second longest bridge built as part of the Woolgoolga to Ballina upgrade.

Memories:

Bert Sneesby: The following account by the Late Bert Sneesby of his memories of the Broadwater Ferry was provided by his daughter, Evelyn Wunch – 1/1/1982.

“When I first crossed the Richmond River at Broadwater on the Broadwater ferry, it was a very small one worked by hand. I came with my parents, brothers and sisters to reside on a cane farm my father had acquired in 1904 from Tucabia on the Clarence River. I resided there and worked until I retired in 1970 at the age of 76 years.

The ferry was operated on a toll system, one penny for a foot passenger, threepence for a horse and rider and sixpence for a two wheeled vehicle. Schoolchildren were free. A rowing boat was provided for foot passengers. There were no set hours, it was a 24 hour a day job.

After a few years tenders were called for working the ferry and the successful tenderer received 11 pounds per month. Later in years a small engine was installed on the ferry which made it a lot easier. Although the engine would not always do the work, then it was back to the old handle. I have been on the ferry when there was a full load and a heavy north easterly wind blowing, the waves would then break over the ferry to a depth of six inches.

When they were cleaning the water hyacinth out of the river, many a time I have had to use a cane knife to cut it off the wire and sometimes an axe was used to cut away willow branches. Around 1927 the ferry sank and was not replaced for three weeks. In 1953 a large new ferry was constructed and went into commission with Mr E. Patch as the ferryman.

During the big flood of February 1954, the ferry ropes were not disconnected in time and the wire anchorage was pulled from the approach leaving the ferry swinging against the mangroves on the eastern side of the river until the flood recede”.

Broadwater Bridge on Opening Day 13/6/2001

Robert Maxwell: I can remember the time when the Nation stopped to view the America’s Cup. This was in September 1983. I was travelling across the Broadwater ferry with my workmates from the Broadwater Sugar Mill, Ray Hunt and Bruce McCaughey when the Ferrymaster had his trusty TV going. Even though the ferry always had a knock in the engine where this played up with the reception, we did see it all happen.

Jennifer Sauer: Our Dad, Col Sauer, worked on the Broadwater ferry. I remember fishing off the Broadwater ferry and catching many a flathead. Also recall our mother showing us where they sank the Bagotville ferry. This ferry can still be seen at low tide.

Bert Plenkovich: Way back in those early days I was in a dance band with Bruce Nicholas and Vin McGuire where we would be employed to play at the dances in the local halls around the district. Those nights when the ferrymaster knew I was out he would have the ferry waiting for me in those early hours of the morning.

Ferrymen: Fred Harwood (who was in charge for 20 years), Mr Adams, Dave Adams, Steve Haurigan, V. Rogers, Frank Williams Richard Eyles, Barny Hyde, Stan Rose, Bill Davis, Laurie Clifford, Barry Watts, Gordan Smith, Steve Corrigan, Tom Rose, Alan Collis, Cameron Mackie, Clive Dawmah, Jack Roberts, Mr S. Stevens, R. Dixon, W. Grill, A. Davis, E. Patch, S. Williams, Clarrie Davis, Vic Davis, H. McLaren, Col Sauer and Warren Robinson.

Bagotville Ferry: Two Ferrymen that missed out from story, were Jack Robinson and Bert Peterson.

Broadwater School Children at the Opening of Broadwater Bridge 13 – 6 – 2001

Ref: Northern Star, Queensland Country Life, Ron Gittoes from Broadwater, Bert Plenkovich from Broadwater, Terry McKeough and Jeff Monti both from Rileys Hill, Ray Hunt from Tuckurimba.

For more rural news, click here.

Tweed Shire News2 years ago

Tweed Shire News2 years ago

Motoring News1 year ago

Motoring News1 year ago

COVID-19 Northern Rivers News3 years ago

COVID-19 Northern Rivers News3 years ago

COVID-19 Northern Rivers News3 years ago

COVID-19 Northern Rivers News3 years ago

Northern Rivers Local News3 years ago

Northern Rivers Local News3 years ago

Health News3 years ago

Health News3 years ago

COVID-19 Northern Rivers News3 years ago

COVID-19 Northern Rivers News3 years ago

NSW Breaking News3 years ago

NSW Breaking News3 years ago