Australian unemployment dropped in March as part-time jobs surged; but this caused an increase in under-employment

In March 2024, ‘real’ Australian unemployment dropped 78,000 to 1,358,000 (down 0.5% to 8.7% of the workforce) as employment reached an all-time high of over 14.2 million.

However, the composition of the workforce changed – part-time employment surged 295,000 (up 6.1%) to 5,164,000 (a new record high). Unfortunately, there was a substantial decrease in full-time employment, down 256,000 (down 2.7%) to 9,103,000 as the composition of the employment market changed significantly.

The rise in part-time employment was correlated to the increase in under-employment, up 75,000 to 1576,000 (10.1%, up 0.5%). In total a massive 2.93 million Australians (18.8%, unchanged) were unemployed or under-employed in March.

The March Roy Morgan Unemployment estimates were obtained by surveying an Australia-wide cross section of people aged 14+. A person is classified as unemployed if they are looking for work, no matter when. The ‘real’ unemployment rate is presented as a percentage of the workforce (employed & unemployed).

- Employment reaches new record high of over 14.2 million in March:

Australian employment increased 39,000 to 14,267,000 in March. Part-time employment drove the increase, up 295,000 (up 6.1%) to a new record high of 5,164,000 while full-time employment dropped 256,000 (down 2.7%) to 9,103,000.

- Australian Unemployment dropped in March with 78,000 fewer looking for work:

In March 1,358,000 Australians were unemployed (8.7% of the workforce, down 0.5%), a decrease of 78,000 from February driven by fewer people looking for part-time work. There were 763,000 (down 70,000) looking for part-time work and 595,000 (down 8,000) looking for full-time work.

- Overall unemployment and under-employment was unchanged in March at 18.8%:

In addition to the unemployed, a further 1.58 million Australians (10.1% of the workforce) were under-employed, i.e. working part-time but looking for more work, up 75,000 from February. In total 2.93 million Australians (18.8% of the workforce) were either unemployed or under-employed in March.

- Comparisons with a year ago show rapidly increasing workforce driving employment growth:

The workforce in March was 15,625,000 (down 39,000 from February, but up a massive 641,000 from a year ago) – comprised of 14,267,000 employed Australians (up 39,000 from a month ago) and 1,358,000 unemployed Australians looking for work (down 78,000).

Although unemployment and under-employment remain high at 2.93 million, there has been a surge in employment over the last year – up by 693,000 to a new record high of 14,267,000.

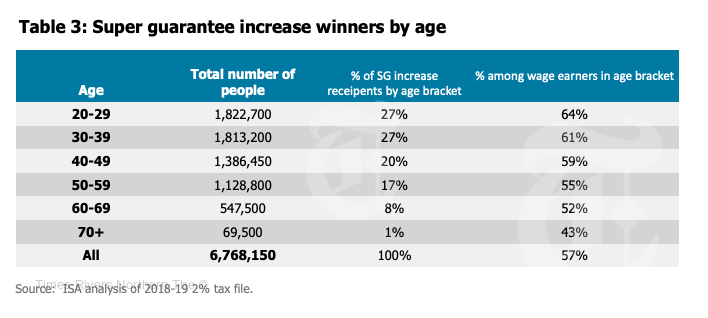

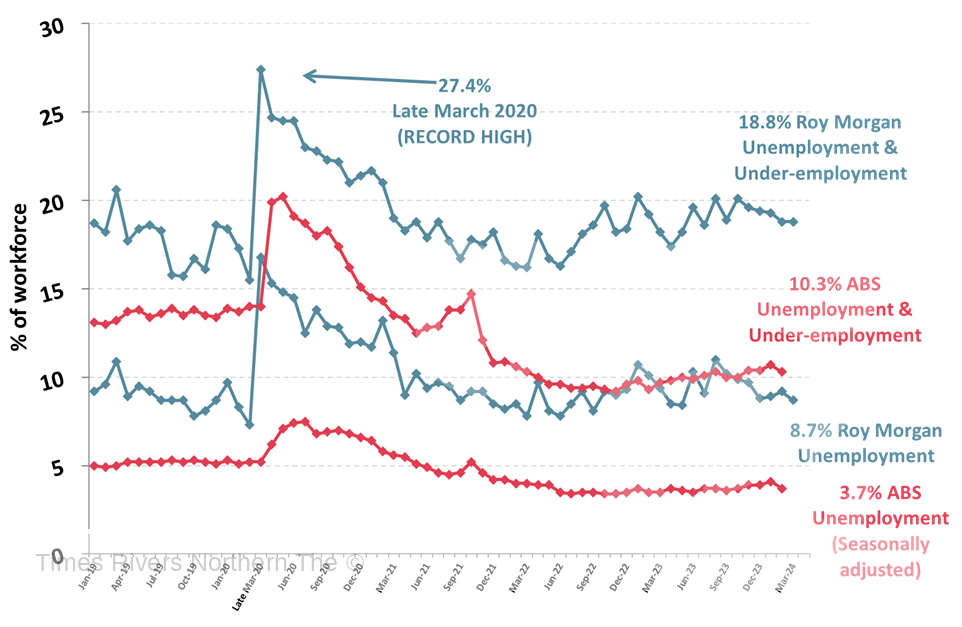

Roy Morgan Unemployment & Under-employment (2019-2024)

Source: Roy Morgan Single Source January 2019 – March 2024. Average monthly interviews 5,000.

Note: Roy Morgan unemployment estimates are actual data while the ABS estimates are seasonally adjusted.

Compared to four years ago in early March 2020, in March 2024 there were almost 800,000 more Australians either unemployed or under-employed (+3.2% points) even though overall employment (14,267,000) is almost 1.4 million higher than it was pre-COVID-19 (12,872,000).

ABS Comparison

Roy Morgan’s unemployment figure of 8.7% is more than double the ABS estimate of 3.7% for February but is approaching the combined ABS unemployment and under-employment figure of 10.3%.

The latest monthly figures from the ABS indicate that the people working fewer hours in February 2024 due to illness, injury or sick leave was 521,700. This is around 140,000 higher than the pre-pandemic average of the five years to February 2019 (382,100) – a difference of 139,600.

If this higher than pre-pandemic average of workers (139,600) is added to the combined ABS unemployment and under-employment figure of 1,533,000 we find a total of 1,673,600 people could be considered unemployed or under-employed, equivalent to 11.3% of the workforce.

For more business news, click here.

Tweed Shire News2 years ago

Tweed Shire News2 years ago

Motoring News1 year ago

Motoring News1 year ago

COVID-19 Northern Rivers News3 years ago

COVID-19 Northern Rivers News3 years ago

COVID-19 Northern Rivers News3 years ago

COVID-19 Northern Rivers News3 years ago

Northern Rivers Local News2 years ago

Northern Rivers Local News2 years ago

Health News3 years ago

Health News3 years ago

COVID-19 Northern Rivers News3 years ago

COVID-19 Northern Rivers News3 years ago

NSW Breaking News3 years ago

NSW Breaking News3 years ago