Aussie small businesses at risk of underinsurance

BIZCOVER

Australian small businesses are at risk of underinsurance, with a recent report showing that many SMEs have become complacent and have no protections in place if a negative event were to occur.

Only 43% of small businesses think they are fully covered from insurable business risks, according to the newly-released bonus chapter of the Vero SME Insurance Index 2022.

While this shows a level of understanding among small businesses about their cover levels, 34% said they have no plan if something bad were to happen, the survey found. Some others haven’t even thought about what might happen or simply choose to cross that bridge when they come to it.

“Small businesses seem to be generally aware that they may be underinsured however due to the additional cost of increasing coverage some may have made a choice to not look further into their cover due to price concerns,” says Jane Mason, Head of Product Channels and Risk at SME insurance platform BizCover,

“What’s worrying is that the dangers of underinsurance can leave the insured in a worse situation if underinsured or not insured at all.”

The conditions are set for an underinsurance crisis

From floods, bushfires, and the Covid-19 pandemic to supply chain issues and the rising cost of living, Australian small businesses have had to contend with multiple problems in recent years.

This has had an impact on the revenue of many businesses, causing some to look for ways to save money.

Vero’s report suggests that SMEs with declining revenue are less likely to say that they are completely covered and are also less likely to have a plan in place for a negative situation.

“It’s tough out there. And unfortunately, some businesses put their insurance on the chopping block,” says Mason. “But what this also says is that the businesses who are more likely to be hit by underinsurance are already struggling.”

Exacerbating the issue is that rising inflation and major supply chain disruptions are pushing up the claims costs for insurance companies, which ultimately results in higher premiums across some types of insurance.

This can put businesses who are renewing their coverage at the same levels as the year before at risk, as the cost of equipment, stock or machinery has, in many cases, increased beyond what they were originally insured for.

“What was adequate cover a year ago may not be adequate cover now because of the rising cost of materials,” says Mason.

The risk of underinsurance

For Aussie businesses, what all this means is that some could be left with a serious financial crisis by not having enough insurance to cover their loss.

For example, say you insure your business for $100k and a fire rips through your store destroying it. Once you factor in the cost to repair your business, the total bill comes out to $160k in damages. That’s $60k you’ll have to pay out of your own pocket.

Another way you can fall into the underinsurance trap is by triggering a underinsurance clause.

These clauses are designed to discourage businesses from purposely undervaluing their assets and are triggered by underinsuring usually by 20% under the true value.

Importantly, this occurs even if the damages fall within the insured amount.

So, in the above example, even if the damages were only $40k, your insurer will not cover that full amount if the clause is triggered despite you having $100k of cover.

“Many people may think that the insurer will cover it since the cost of the damages easily falls within the insured amount but that is sometimes not the case if the business is underinsured,” says Mason. “If you purchase below what your business’ true value is, you could become responsible for the share of the loss and not receive full payment for your claim.”

What can small businesses do?

While the current situation is tough, there are some things Australian small business owners can do to avoid being underinsured.

Regularly scheduling some time to consider your exposure to risks could help avoid problems later down the track. This will allow you to consider what risks your business is exposed to and think about the possible scenarios that could happen if you weren’t protected in the event of a claim.

“It’s important to insure your business for an amount that is sufficient to cover not only the tangible assets, but the cost of repairs and any other variables that might leave you out of pocket,” says Mason. “After that, consider jumping online to compare quotes so you could then decide whether the price of the cover justifies the protection.”

While reviewing your cover at renewal is a great time to consider your options, you could check in at any point throughout the year.

And with inflation and the cost of claims rising, it’s become even more crucial to regularly keep track of the actual value of your building and business contents to avoid being left with inadequate cover if a claim were to arise.

*This information is general only and does not take into account your objectives, financial situation or needs. It should not be relied upon as advice. As with any insurance, cover will be subject to the terms, conditions and exclusions contained in the policy wording. © 2022 BizCover Pty Limited, all rights reserved. ABN 68 127 707 975; AFSL 501769

Tweed Shire News2 years ago

Tweed Shire News2 years ago

Motoring News1 year ago

Motoring News1 year ago

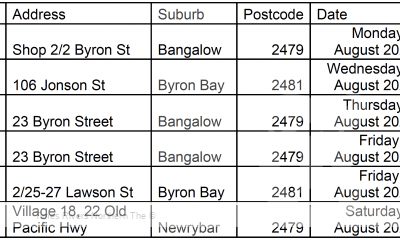

COVID-19 Northern Rivers News3 years ago

COVID-19 Northern Rivers News3 years ago

COVID-19 Northern Rivers News3 years ago

COVID-19 Northern Rivers News3 years ago

Northern Rivers Local News3 years ago

Northern Rivers Local News3 years ago

Health News3 years ago

Health News3 years ago

COVID-19 Northern Rivers News3 years ago

COVID-19 Northern Rivers News3 years ago

NSW Breaking News3 years ago

NSW Breaking News3 years ago